-In the above figure

Definitions:

Reward-to-Variability Ratio

A ratio used to evaluate the return of an investment relative to its risk, with a higher ratio indicating a more favorable risk-reward profile.

Risk-free Rate

A presumed income from an investment that is free from any financial risk, typically reflected through government bond yields.

Efficient Frontier

A set of optimal portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return, used in modern portfolio theory.

Expected Return

The projected profitability of an investment over a given period.

Q25: What is needs-tested spending and how does

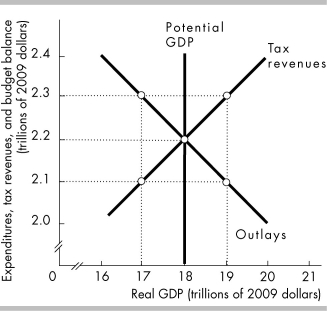

Q119: The government estimates that the natural unemployment

Q132: What was the U.S. experience with demand

Q176: An increase in taxes on labor income

Q181: An increase in tax rates as a

Q190: Which of the following is a potential

Q227: The core inflation rate is more volatile

Q239: Which theory maintains that the money wage

Q256: If the natural unemployment rate increases, then

Q319: Stagflation is the combination of a _