Below is information from Darren Company's 2012 financial statements.

Cash and short-term investments Accounts Receivable (net) Inventories Prepaid Expenses and other current assets Total CurrentAssets Plant, Property and Equipment, net Intangible Assets Total Assets Short-term borrowings Current portion of long-term debt Accounts payable Accrued liabilities Income taxes payable Total Current Liabilities Long-term Debt Total Liabilities Shareholders’Equity Total Liabilities and Shareholders’ Equity $958,245125,850195,65045,300$1,325,0451,478,320125,600$2,928,965$25,19045,000285,400916,722125400$1,397,712450,000$1,847,712$1,081,253$2,928,965$745,800135,400175,84030,860$1,087,9001,358,700120,400$2,567,000$38,10840,000325,900705,891115600$1,225,499430,000$1,655,499$911,501$2,567,000

Selected Incame Statement Data - for the year ending December 31,2012 Net Sales Cast of Goods Sold Operating Incame Net Incame Selected Statement of Cash Flaw Data - for the year ending December 31,2012 Cash Flows fram Operations Interest Expense Incame Tax Expense $3,210,5452,310,210)900,435324,650$584,75042,400114,200

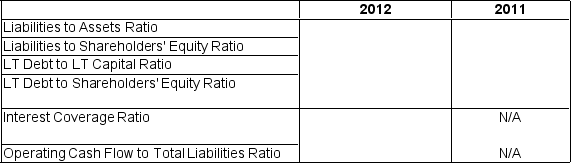

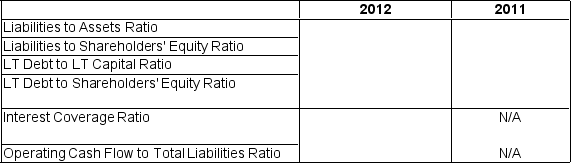

Using this information,calculate the following ratios:

Definitions:

Dissociative Identity Disorder

A psychiatric disorder characterized by the presence of two or more distinct personality states that control an individual's behavior at different times.

Dissociative Fugue

A rare psychiatric disorder characterized by reversible amnesia for personal identity, including the memories, personality, and other identifying characteristics of individuality.

Etiology

The study of the causes or origins of diseases or conditions.

Concordance Rates

Statistical measures used in genetics to indicate the likelihood of a trait or condition being shared among individuals with a genetic relationship.