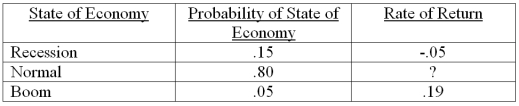

Northern Wear stock has an expected return of 14.6 percent. Given the information below, what is the expected return on this stock if the economy is normal?

Definitions:

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption or the wear and tear over time.

Long-Term Debt

Loans and financial obligations lasting more than one year, used to finance a company's operations or expansions.

Direct Approach

A method in financial accounting that involves reporting major classes of gross cash receipts and payments, providing a clear view of a company's cash flow.

Indirect Approach

A method for preparing the cash flow statement where net income is adjusted for non-cash transactions, deferred taxes, and changes in working capital.

Q4: The aftertax cost of which of the

Q15: Kate is the sole founder of the

Q25: The Flour Baker is considering a project

Q26: What is the beta of the following

Q30: Firm A uses straight-line depreciation. Firm B

Q36: Gabella's is an all-equity firm that has

Q40: A security produced returns of 12 percent,

Q42: Sly's just arranged a 3-year direct business

Q55: You own a stock that has an

Q92: The common stock of Mid-Towne Movers is