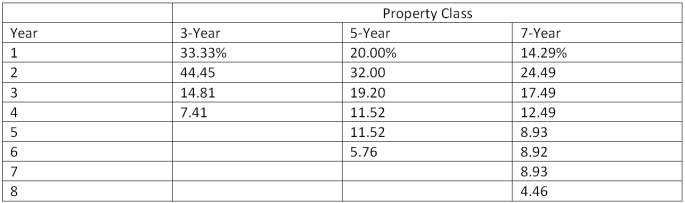

An asset used in a 3-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $5.4 million and will be sold for $1.2 million at the end of the project. If the tax rate is 35 percent, what is the aftertax salvage value of the asset?  Table 9.7 Modified ACRS depreciation allowances

Table 9.7 Modified ACRS depreciation allowances

Definitions:

Deviation Bar Chart

Deviation bar chart is a type of bar graph that displays data in relation to a central value, illustrating differences or variations from the norm.

Dynamic Display

A type of visual presentation that can change or update in real-time based on user interactions or other variables.

Internal Labels

Markings or names used within an organization to identify, categorize, or classify certain processes, products, or information.

External Labels

Markings or identifications placed on the outside of a package or product to provide information or for branding purposes.

Q10: Southwest Tours currently has a weighted average

Q15: Which of the following will decrease the

Q54: What term is used to describe an

Q55: Tom earned $120 in interest on his

Q71: Which of the following statements correctly relate

Q88: You purchased a zero-coupon bond one year

Q88: A firm has multiple divisions of similar

Q90: Which one of the following principles refers

Q95: If an investment is producing a return

Q102: You purchase a bond with a coupon