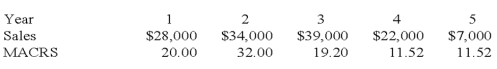

The Blue Lagoon is considering a project with a five-year life. The project requires $110,000 of fixed assets that are classified as five-year property for MACRS. Variable costs equal 71 percent of sales, fixed costs are $9,600, and the tax rate is 35 percent. What is the operating cash flow for year 4 given the following sales estimates and MACRS depreciation allowance percentages?

Definitions:

Total Revenue

The entire amount of income generated by the sale of goods or services before any costs are subtracted.

Economic Costs

The total cost of choosing one action over another, consisting of both explicit costs (direct monetary outlays) and implicit costs (the value of opportunities foregone).

Accounting Degree

An academic degree that prepares students for careers in accounting, focusing on areas like auditing, tax, financial reporting, and management accounting.

Economic Profits

Profits calculated by subtracting both explicit and implicit costs from total revenue.

Q9: You own a portfolio that is invested

Q16: You own a $46,000 portfolio comprised of

Q37: Which one of the following is defined

Q49: Explain the primary difference between a Chapter

Q53: The inflation premium:<br>A) increases the real return.<br>B)

Q55: A stock produced returns of 16 percent,

Q76: River Rock, Inc. just paid an annual

Q90: All else constant, which of the following

Q91: If the financial markets are semi-strong form

Q104: Which one of the following represents additional