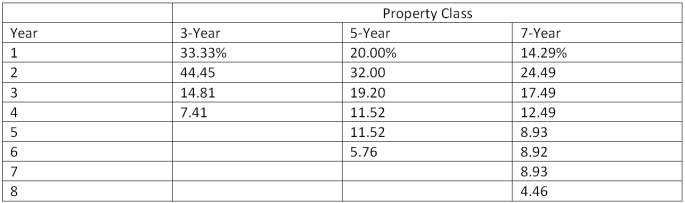

An asset used in a 3-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $5.4 million and will be sold for $1.2 million at the end of the project. If the tax rate is 35 percent, what is the aftertax salvage value of the asset?  Table 9.7 Modified ACRS depreciation allowances

Table 9.7 Modified ACRS depreciation allowances

Definitions:

Canada

A country in North America known for its vast landscapes, multicultural population, and as a member of the Commonwealth.

United States

A country comprising 50 states, a federal district, five major self-governing territories, and various possessions, characterized by a federal republic form of government.

Safer Sex

Avoiding sexual behaviours that are considered high risk as well as engaging in various types of nongenital contact.

Passive

Characterized by lack of active response or action, often implying acquiescence or submission.

Q2: An individual who executes buy and sell

Q4: Which one of the following terms is

Q18: Given the following information, what is the

Q27: Services United is considering a new project

Q38: The Furniture Showroom offers credit to its

Q42: The common stock of Yanderloft and Sons

Q54: Payback is best used to evaluate which

Q93: You are assigned the task of computing

Q93: Over the last four years, the common

Q94: Which one of the following statements is