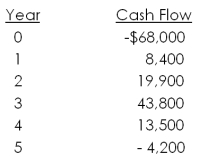

Miller and Sons is evaluating a project with the following cash flows:  The company uses a 10 percent interest rate on all of its projects. What is the MIRR of the project using the reinvestment approach? The discounting approach? The combination approach?

The company uses a 10 percent interest rate on all of its projects. What is the MIRR of the project using the reinvestment approach? The discounting approach? The combination approach?

Definitions:

Bond Issuance Costs

Costs related to issuing bonds and debt securities, such as underwriting fees, legal fees, and registration fees, which are amortized over the life of the bond.

Underwriters

Financial specialists who assess and undertake the risk of another party for a fee, often in the context of issuing insurance policies or investment securities.

Discount

A reduction in the price of goods or services usually to encourage sales or to reward specific groups of customers.

Premium

In finance, a premium refers to the amount by which the price of a financial asset or insurance policy exceeds its intrinsic or face value.

Q1: A project will reduce costs by $34,000

Q10: If a project with conventional cash flows

Q29: Stock J has a beta of 1.17

Q41: Curtis is considering a project with cash

Q52: Raceway Motors issued a 20-year, 8 percent

Q55: A debt-free firm has net income of

Q65: A stock is expected to return 13

Q65: Assume the securities markets are strong-form efficient.

Q70: You are buying a bond at a

Q88: Which of the following will increase the