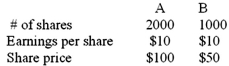

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is,after the merger,there are 2500 shares of A outstanding) .If investors are aware that there are no economic gains from the merger,what is the price-earnings ratio of A's stock after the merger?

Definitions:

Annual Investment

The amount of money invested in a particular asset or project on a yearly basis.

Time Value

The concept that money available in the present is worth more than the same amount in the future due to its earning capacity.

Payback Period

A way to determine the duration required for an investment to reach a point where returns equal the costs, providing a simple tool for evaluating project viability.

Net Cash Flow

The difference between a company’s cash inflows and outflows over a specific period, indicating its financial health.

Q1: Project financing is often designed to reduce

Q3: A patient who has psoriasis will begin

Q4: The nurse provides teaching to a man

Q5: Briefly describe the most widely used commercial

Q6: A patient who has received heparin after

Q10: The nurse is preparing to administer doses

Q16: XJ Company from the U.S.is evaluating a

Q23: The legal systems in France,Germany,and Scandinavia have

Q61: In general,the countries with the highest interest

Q63: Your U.S.-based firm is deciding between using