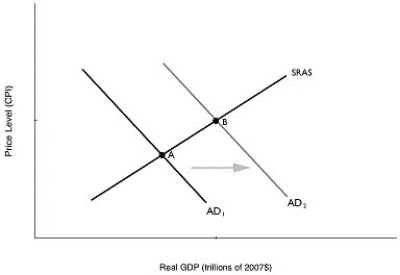

Figure 12.13  Alt text for Figure 12.13: In figure 12.13, a graph depicting the shift in aggregate demand.

Alt text for Figure 12.13: In figure 12.13, a graph depicting the shift in aggregate demand.

Long description for Figure 12.13: The x-axis is labelled, real GDP (trillions of 2007 dollars) , and the y-axis is labelled, price level (CPI) .3 lines are shown; AD1, AD2, and SRAS.Line AD1 begins at the top left corner and slopes down to the bottom center.Line AD2 follows the same slope as line AD1, but is plotted to the right.The area between lines AD1 and AD2 is indicated by a right pointing arrow.Line SRAS intersects line AD1 at point A, more than half way along line AD1.Line SRAS intersects line AD2 at point B, less than half way along line AD2.

-Refer to Figure 12.13.An increase in government purchases of $20 billion causes aggregate demand to shift ultimately from AD1 to AD2.The difference in real GDP between point A and point B will be ________ $20 billion.

Definitions:

Yield Curve

The relationship between interest rates and the term of debt, generally expressed graphically. A normal yield curve is upsloping, reflecting rates that increase with increasing term. An inverted curve is downsloping.

Liquidity Premiums

Additional yield that investors require for holding securities with lower liquidity.

Maturity Risk Premium

The additional interest rate or yield that investors demand to hold longer-maturity debt over shorter-term instruments.

Lenders

Individuals or institutions that provide funds to borrowers under the agreement that the funds will be repaid with interest.

Q4: Workers at a local mining company are

Q7: If the Bank of Canada orders an

Q69: What is a mortgage? What were the

Q119: Calculate the value of the government purchases

Q140: Over the past two decades,whenever changes in

Q193: Ceteris paribus,an increase in the current or

Q233: Falling interest rates can<br>A)increase a firm's stock

Q272: The Bank of Canada can use contractionary

Q290: To combat a recession with discretionary fiscal

Q297: Which of the following would be classified