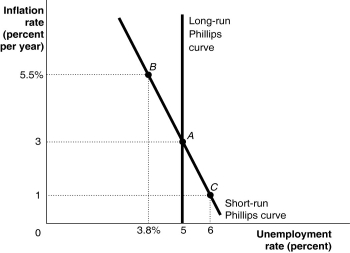

Figure 13.2  Alt text for Figure 13.2: In figure 13.2, a graph shows the short-run and long-run Phillips curves.

Alt text for Figure 13.2: In figure 13.2, a graph shows the short-run and long-run Phillips curves.

Long description for Figure 13.2: The x-axis is labelled, unemployment rate (percent) .The y-axis is labelled, inflation rate (percent per year) .3 points; A (5, 3) , B (3.8%, 5.5%) , C (6, 1) are plotted on the graph.The points are connected to their respective coordinates on the x and y-axes with dotted lines.A straight line labelled, short-run Philips Curve, begins at the top left corner and slopes down to the bottom center, and passes through points A, B, and C.A straight line labelled, long-run Philips Curve, is perpendicular to the x-axis, begins from the x-axis value 5,and intersects the Short-run Philips Curve at point A.

-Refer to Figure 13.2.At which point are inflation expectations equal to the actual inflation rate?

Definitions:

Debt

Debt is an amount of money borrowed by one party from another, under the condition that it is to be repaid at a later date, usually with interest.

Restrictive Covenants

Provisions in a contract or bond agreement that limit certain actions of the borrower, to protect the interests of the lender.

Corporate Taxes

Taxes imposed on the income or profit of corporations by the government.

Personal Taxes

Taxes imposed on individuals or households based on their income, investments, or other personal activities.

Q2: The tax multiplier equals the change in

Q18: The use of fiscal policy to stabilize

Q36: Although the U.S.Federal Reserve had traditionally made

Q70: When net capital flows are positive,<br>A)capital inflows

Q89: In October 2008,the U.S.Congress passed the _,under

Q119: An increase in Canadian net foreign direct

Q153: Under the Bretton Woods exchange rate system,set

Q193: In the 1960s and 1970s,the majority of

Q201: Matt's real wage in 2017 is $26.80.If

Q232: The current account includes records of a