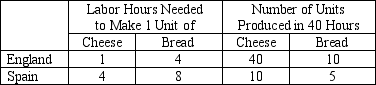

Table 3-5

Assume that England and Spain can switch between producing cheese and producing bread at a constant rate.

-Refer to Table 3-5.At which of the following prices would both England and Spain gain from trade with each other?

Definitions:

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 indicates higher than market volatility.

Expected Return

The predicted amount of gain or loss an investment is projected to generate, based on historical or anticipated rates of return.

Portfolio

An aggregation of financial holdings that includes stocks, bonds, commodities, cash, cash equivalents, closed-end funds, and exchange traded funds (ETFs).

Systematic Risk

The inherent risk that affects the entire market or a whole segment of the market, often influenced by geopolitical and economic factors.

Q76: The highest form of competition is called<br>A)

Q86: Refer to Table 3-6.The opportunity cost of

Q91: Refer to Figure 2-15.Which of the following

Q164: Refer to Figure 3-7.If the production possibilities

Q220: Differences in scientific judgement between economists is

Q263: The slope of a steep upward-sloping line

Q343: A leftward shift of a supply curve

Q346: Refer to Table 3-6.The opportunity cost of

Q364: The Federal Reserve<br>A) designs tax policy.<br>B) enforces

Q381: A survey of professional economists revealed that