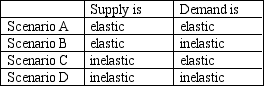

Table 5-6

-Refer to Table 5-6.Which scenario describes the market for oil in the short run?

Definitions:

Book Value

The net value of a company's assets minus its liabilities and preferred stock, representing the value of the company according to its financial statements.

Expected Earnings

Predictions or estimates of a company's profit during a specific period in the future, often used by investors to make informed decisions.

Unlevered Cost

The cost of an investment that does not take into account the effect of financial leverage, or borrowing.

Debt-Equity Ratio

The debt-equity ratio is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets.

Q6: Reta's income elasticity of demand for steak

Q80: Total revenue will be at its largest

Q152: If a 20% change in price results

Q222: If the government removes a binding price

Q266: Refer to Figure 6-12.When the price ceiling

Q294: If a tax is levied on the

Q300: An increase in the price of cotton

Q322: Refer to Scenario 5-3.The change in equilibrium

Q402: A decrease in supply will cause the

Q487: The imposition of a binding price floor