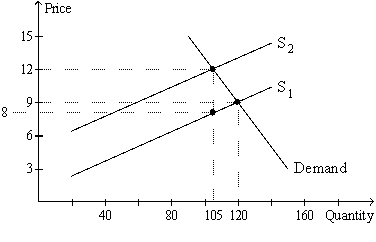

Figure 6-17

-Refer to Figure 6-17.Suppose buyers,rather than sellers,were required to pay this tax (in the same amount per unit as shown in the graph) .Relative to the tax on sellers,the tax on buyers would result in

Definitions:

Working Capital

The difference between a company’s current assets and current liabilities, used to fund the company's day-to-day operations.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of tax applied to your next dollar of income.

Net Investment

The total amount spent by a company or economy on capital assets, minus depreciation. This indicates how much is being spent on new or replacement assets.

Accounts Receivable

Funds that customers owe to a business for products or services that have been provided but not yet compensated for.

Q42: If the quantity supplied responds only slightly

Q81: Suppose Katie,Kendra,and Kristen each purchase a particular

Q109: The minimum wage has its greatest impact

Q131: A $0.10 tax levied on the sellers

Q317: Which of the following would be the

Q347: Refer to Table 7-5.If the market price

Q401: Dallas buys strawberries,and he would be willing

Q409: Refer to Figure 7-8.When the price rises

Q409: The price elasticity of demand is defined

Q474: Price floors are typically imposed to benefit