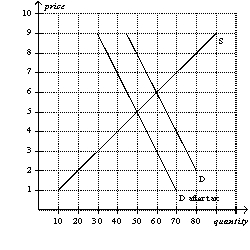

Figure 6-21

-Refer to Figure 6-22.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the sellers of the good,rather than the buyers,are required to pay the tax to the government.After the sellers are required to pay the tax,relative to the case depicted in the graph,the burden on buyers will be

Definitions:

Variable Selling

Refers to costs that vary directly with the level of sales, such as commissions or shipping fees.

Idle Capacity

The portion of a company's resources, such as labor or machinery, that is not being used to its full potential during the production process.

Joint Processing Costs

The expenses incurred during the initial stages of processing where multiple products are produced simultaneously before they are split into separate components.

Split-off Point

The stage in a production process where multiple products are derived from a single input or process, each taking a different processing route afterward.

Q91: A tax imposed on the buyers of

Q110: If the government passes a law requiring

Q130: A price ceiling is binding when it

Q190: Refer to Figure 6-6.Which of the following

Q197: Refer to Figure 6-19.Which of the following

Q250: Refer to Figure 7-3.Which area represents the

Q328: The cross-price elasticity of garlic salt and

Q367: The marginal seller is the seller who<br>A)

Q498: Price controls are usually enacted<br>A) as a

Q525: Regardless of whether a tax is levied