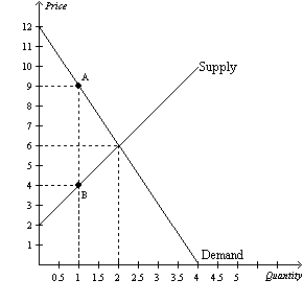

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.Total surplus without the tax is

Definitions:

Terminate

To bring to an end; this can relate to employment, contracts, or services, among others.

Corporate Alternative Minimum Tax

A parallel tax system aimed at ensuring that corporations pay at least a minimum amount of tax, regardless of deductions or credits that would otherwise lower their tax bill.

Exemption Amount

This refers to a specific dollar amount that taxpayers can claim for themselves and their dependents to reduce taxable income.

Parent-Subsidiary Group

A group consisting of a parent company and one or more subsidiaries, which are companies controlled by the parent company.

Q46: When a country allows trade and becomes

Q48: The Laffer curve illustrates that<br>A) deadweight loss

Q99: Diana is a personal trainer whose client

Q184: Refer to Figure 7-21.If the government mandated

Q220: Because taxes distort incentives,they cause markets to

Q247: The deadweight loss from a tax<br>A) does

Q288: Normally,both buyers and sellers of a good

Q325: Refer to Figure 8-4.The price that sellers

Q376: Refer to Figure 9-10.The area bounded by

Q415: Bill created a new software program he