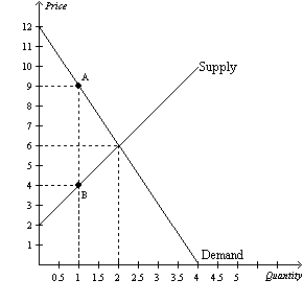

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.The loss of producer surplus associated with some sellers dropping out of the market as a result of the tax is

Definitions:

Absorption Costing

An accounting method that includes all direct costs and overhead costs related to the production of a specific product.

Product Costs

Expenses directly attributable to the creation of a product, including material, labor, and overhead costs.

Variable Costing

A costing method that only includes variable production costs in product costs, treating fixed manufacturing costs as period expenses.

Product Costs

Costs that are directly tied to the production of goods, including raw materials, direct labor, and manufacturing overhead.

Q58: Assume,for Canada,that the domestic price of wheat

Q72: When a country allows international trade and

Q132: Refer to Figure 9-5.The horizontal line at

Q133: Refer to Figure 8-5.The tax causes a

Q153: Which of the following statements is correct

Q199: Consumer surplus is the amount a buyer

Q289: The supply curve for liquor is the

Q344: For any country,if the world price of

Q389: When a good is taxed,the burden of

Q401: When a good is taxed,the tax revenue