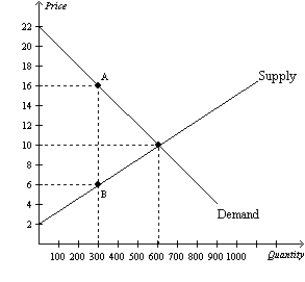

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.Without a tax,total surplus in this market is

Definitions:

Current Dividend

The most recent dividend payment approved by a company's board of directors and distributed to its shareholders.

Yld%

A financial metric typically used to refer to the yield percentage of a bond, indicating the return investors can expect to earn if they hold the bond until maturity.

EPS Growth Rate

The rate at which a company's earnings per share (EPS) are expected to grow over a certain period of time.

Rate of Return

The increase or decrease in the value of an investment during a specified time frame, shown as a percentage of the investment's original price.

Q35: When a tax is imposed on a

Q134: When a country allows trade and becomes

Q151: Refer to Figure 8-11.The price labeled as

Q213: Refer to Figure 8-8.The deadweight loss of

Q239: Inefficiency can be caused in a market

Q245: Which of the following is a tax

Q369: When a good is taxed,<br>A) both buyers

Q378: The more inelastic are demand and supply,the

Q387: Taxes are costly to market participants because

Q407: Refer to Figure 8-6.When the tax is