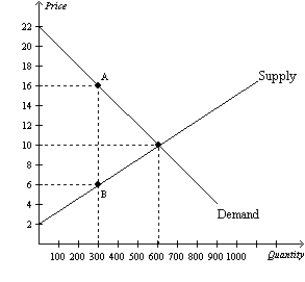

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.When the tax is imposed in this market,the price buyers effectively pay is

Definitions:

AGI

Adjusted Gross Income, which is total income minus specific deductions, used to determine tax liability.

Adoption Credit

A tax credit offered by the IRS to offset some expenses involved in the legal adoption of a child.

Modified AGI

Modified Adjusted Gross Income, an income measure used for tax purposes, adjusting the AGI for specific deductions or exclusions.

Qualified Adoption Expenses

Allowable adoption-related expenses that may be eligible for tax credits, including court costs, attorney fees, and traveling expenses.

Q13: Refer to Figure 9-5.Bearing in mind that

Q19: Refer to Scenario 8-2.If Stephanie hires Tom

Q24: If a market is allowed to adjust

Q55: Refer to Figure 8-2.The loss of consumer

Q268: Refer to Figure 9-12.Producer surplus after trade

Q295: If producing a soccer ball costs Jake

Q309: Refer to Figure 8-4.The equilibrium price before

Q362: Suppose New Zealand goes from being an

Q396: Refer to Figure 8-11.Suppose Q<sub>1</sub> = 4;

Q405: Which of the following is not correct?<br>A)