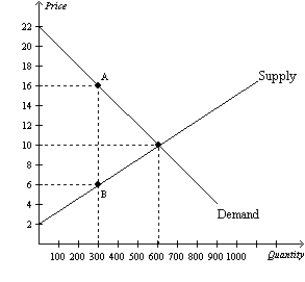

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.When the tax is imposed in this market,buyers effectively pay what amount of the $10 tax?

Definitions:

Reimbursing

The act of compensating someone for expenses they have incurred on your behalf.

Holder in Due Course

A term that refers to a party who has acquired a negotiable instrument in good faith and for value, and thus has certain rights above the original payee.

Requirements

Conditions or capabilities needed for something to be achieved, such as the specifications for software or the qualifications for a job.

Holder-in-Due-Course Status

Holder-in-due-course status refers to a legal protection granted to the holder of a negotiable instrument, who takes the instrument for value, in good faith, and without notice of any defects or claims against it.

Q40: A tariff on a product<br>A) is a

Q76: Refer to Figure 9-2.As a result of

Q90: Raisin bran and milk are complements.An increase

Q193: Refer to Figure 8-9.The imposition of the

Q218: Refer to Figure 8-4.The tax results in

Q222: Refer to Figure 9-10.The price and quantity

Q324: Motor oil and gasoline are complements.If the

Q324: Refer to Figure 9-5.With trade,consumer surplus is<br>A)

Q345: Refer to Figure 7-17.When the price is

Q436: Given the following two equations:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4798/.jpg"