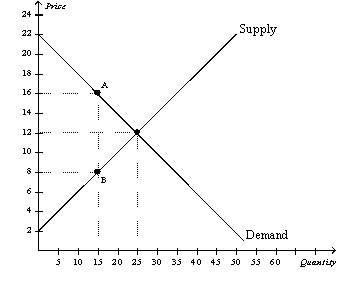

Figure 8-7

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-7.Which of the following statements is correct?

Definitions:

Variable Expenses

Costs that change in proportion to the activities or volume of a business.

Net Operating Income

A measure of a company's profitability from its regular business operations, excluding expenses and revenues that are unrelated to the primary business activities.

Absorption Costing

Absorption costing is an accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - in the cost of a product.

Variable Costing

An accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in product costs, excluding fixed manufacturing overhead.

Q1: Refer to Figure 7-8.Which area represents the

Q3: Total surplus in a market will increase

Q84: Refer to Figure 8-6.When the tax is

Q179: Refer to Figure 8-5.After the tax is

Q204: Refer to Figure 7-5.If the government imposes

Q239: Inefficiency can be caused in a market

Q272: If a country is an exporter of

Q310: Refer to Figure 8-6.The tax results in

Q317: Assume,for the U.S.,that the domestic price of

Q344: Refer to Table 7-11.Both the demand curve