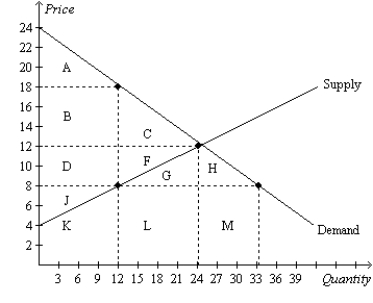

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The tax causes producer surplus to decrease by the area

Definitions:

Put Option

A financial contract giving the buyer the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specific time.

Strike Price

A term synonymously used with Exercise Price, indicating the fixed price at which an option holder can buy or sell the underlying asset.

Contract Maturity

The predetermined date on which a financial contract, such as a bond or a futures contract, expires or is settled.

Stock Price

The monetary value at which a company’s stock is traded on the market, influenced by factors like company performance and market conditions.

Q100: Refer to Figure 7-9.If the supply curve

Q115: Refer to Figure 9-6.The amount of revenue

Q185: Refer to Figure 8-1.Suppose the government imposes

Q190: The loss in total surplus resulting from

Q241: Refer to Figure 8-1.Suppose the government imposes

Q252: Refer to Table 7-11.The equilibrium price is<br>A)

Q291: The idea that tax cuts would increase

Q301: Refer to Figure 8-5.The tax is levied

Q323: Refer to Figure 7-6.What happens to the

Q443: Refer to Figure 7-13.If the price of