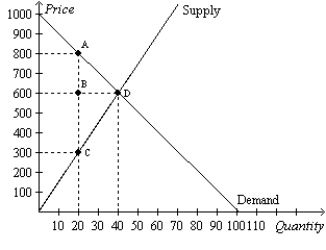

Figure 8-9

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The imposition of the tax causes the price paid by buyers to increase by

Definitions:

Transfer Price

The price at which goods and services are transferred between departments or subsidiaries of the same company.

Variable Cost

Costs that vary directly with the level of production or sales volume, such as raw materials or direct labor.

General Transfer-Pricing Formula

A method or set of guidelines used to determine the price at which goods and services are transferred between departments or divisions within the same company.

Transfer Price

The cost at which products and services are exchanged among departments within the same corporation.

Q107: To fully understand how taxes affect economic

Q122: The demand for potted plants is more

Q125: Suppose that the equilibrium price in the

Q130: When a tax is imposed on sellers,producer

Q174: Suppose a tax of $1 per unit

Q222: Refer to Figure 9-10.The price and quantity

Q312: Refer to Figure 8-7.Suppose a 22nd unit

Q336: Which of the following statements correctly describes

Q353: Refer to Figure 8-2.Consumer surplus without the

Q376: Refer to Figure 9-10.The area bounded by