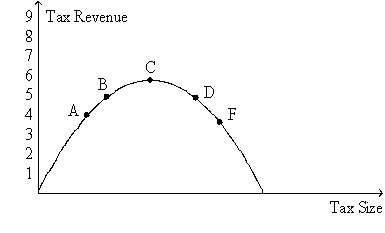

Figure 8-20. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.

-Refer to Figure 8-20.For an economy that is currently at point D on the curve,a decrease in the tax rate would

Definitions:

Business Capital Investment

Business capital investment involves the allocation of financial resources by businesses into long-term assets or projects expected to generate future returns or growth.

U.S. Corporations

are business entities that are registered and operate in the United States, subject to U.S. laws, and often characterized by their complex structure, governance, and operations.

Small Businesses

Enterprises that are independently owned and operated, characterized by fewer employees and less revenue than larger corporations.

Managerial Functions

The primary roles of managers, which typically include planning, organizing, leading, and controlling within an organization.

Q1: Refer to Figure 8-6.Total surplus with the

Q20: Refer to Figure 9-2.The world price for

Q117: As the size of a tax rises,the

Q289: Refer to Figure 7-22.At the quantity Q3,<br>A)

Q364: The decrease in total surplus that results

Q379: Refer to Figure 7-20.At equilibrium,consumer surplus is<br>A)

Q380: If the United States changed its laws

Q401: Trade enhances the economic well-being of a

Q403: If Belgium exports chocolate to the rest

Q434: Economists argue that restrictions against ticket scalping