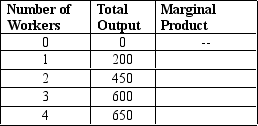

Table 12-2

-Refer to Table 12-2.What is the marginal product of the first worker?

Definitions:

Net Operating Income

A financial term representing the profit made from a company’s operations, after subtracting operating expenses from operating income.

Absorption Costing

The product cost determination method under this accounting strategy includes the expenses for direct materials, direct labor, and all manufacturing overhead, whether it is variable or fixed.

Gross Margin

A company's total sales revenue minus its cost of goods sold, divided by the total sales revenue, expressed as a percentage.

Variable Costing

An accounting method that includes only variable production costs (materials, labor, and overhead) in product costs and treats fixed manufacturing overhead as an expense of the period.

Q30: A view of a spectacular sunset along

Q63: In some cases the government can make

Q64: Refer to Table 12-16.Firm B is experiencing

Q166: Refer to Table 11-2.Suppose the cost to

Q235: Refer to Table 12-2.At which number of

Q249: Refer to Scenario 12-10.The implicit cost for

Q293: Private decisions about consumption of common resources

Q333: Refer to Table 13-4.For a firm operating

Q398: When a factory is operating in the

Q417: A firm's total profit equals its marginal