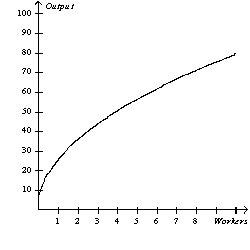

Figure 12-2

-Refer to Figure 12-2.As the number of workers increases,

Definitions:

Interest Tax Shield

A reduction in taxable income for an individual or corporation achieved by deducting interest paid on their loans.

Debt-Equity Ratio

Debt-Equity Ratio measures a company's financial leverage, calculated by dividing its total liabilities by its stockholders' equity.

Capital Asset Pricing Model

A model that describes the relationship between systematic risk and expected return for assets, particularly stocks, used to assess the risk of adding a new asset to a portfolio.

M&M Proposition II

This financial theory, originating from Modigliani and Miller, states that a firm's cost of equity increases as the firm increases its level of debt financing, holding everything else constant.

Q4: Anna borrows $5,000 from a bank and

Q20: Suppose a firm in a competitive market

Q35: Refer to Table 12-12.What is the average

Q48: The difference between specific knowledge and general

Q156: Refer to Figure 12-8.Quantity B represents the

Q205: Average total cost tells us the<br>A) total

Q306: When economists speak of a firm's costs,they

Q406: A certain firm manufactures and sells computer

Q433: A competitive firm has been selling its

Q502: The marginal-cost curve intersects the average-total-cost curve