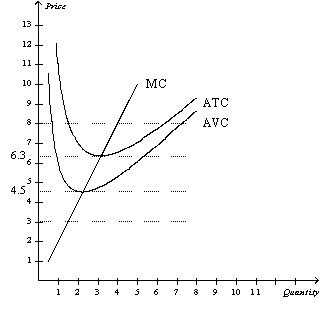

Figure 13-1

Suppose that a firm in a competitive market has the following cost curves:

-Refer to Figure 13-1.If the market price falls below $4.50,the firm will earn

Definitions:

Market Interest Rates

The prevailing rates at which borrowers can obtain loans and lenders can deposit funds in the financial markets, influenced by supply and demand, inflation, and monetary policy.

Bond's Price

The current market value of a bond, which can fluctuate based on interest rate movements and the bond's credit quality.

Present Value

The immediate financial value of a future cash sum or succession of cash inflows, evaluated with a specified return rate.

Expected Cash Flows

Forecasted cash inflows and outflows for a business or project, often used in financial modeling to evaluate investment viability.

Q15: When new firms have an incentive to

Q22: Carol owns a running shoe store that

Q151: By comparing marginal revenue and marginal cost,a

Q177: When a monopolist increases the amount of

Q293: A firm's incentive to compare marginal revenue

Q294: Marginal costs are costs that do not

Q297: Profit-maximizing firms in a competitive market produce

Q298: If long-run average total cost decreases as

Q320: Refer to Table 12-9.What is the marginal

Q434: When average total cost rises if a