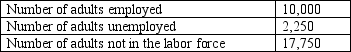

Table 20-5

2010 Labor Data for Tajnia

-Refer to Table 20-5.The labor-force participation rate of Tajnia in 2010 is about 40.8 percent.

Definitions:

Social Security Tax

A tax levied on both employers and employees to fund the Social Security program, which provides benefits for retirees, disabled persons, and survivors.

Medicare Tax

A federal tax deducted from an employee's paycheck to fund the Medicare program.

Unemployment Tax

Taxes paid by employers to fund the unemployment insurance program, providing financial assistance to unemployed workers.

Federal Income Tax

A tax levied by the U.S. government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Q41: If the efficient market hypothesis is correct,then<br>A)

Q161: In the United States,currency holdings per person

Q242: The banking system currently has $10 billion

Q244: An increase in the minimum wage<br>A) increases

Q357: Refer to Table 20-3.What is the adult

Q368: Teenagers have more frequent unemployment spells so

Q463: Who of the following is counted as

Q481: Providing training for unemployed individuals is primarily

Q501: Refer to Table 20-3.What is the adult

Q555: Unions<br>A) do not affect the natural rate