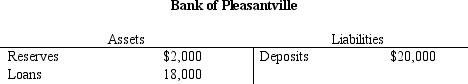

Table 21-5.

-Refer to Table 21-5.Assume the Fed's reserve requirement is 9 percent and all banks besides the Bank of Pleasantville are exactly in compliance with the 9 percent requirement.Further assume that people hold only deposits and no currency.Starting from the situation as depicted by the T-account,if the Bank of Pleasantville decides to make new loans so as to end up with no excess reserves,then by how much does the money supply eventually increase?

Definitions:

External Uncertainty

The unpredictability in an organization's external environment that can affect its operations and performance, including economic, social, and political factors.

Internal Uncertainty

Uncertainty that originates within an organization due to factors like unclear objectives, lack of managerial direction, or unpredictable environments.

Classical Organization

A theory or model of management that focuses on efficiency, hierarchy, and strict roles within an organization to achieve its goals.

Intrinsic Rewards

Non-monetary rewards that come from the satisfaction of doing a job, such as personal achievement or professional growth.

Q32: The efficiency-wage theory of worker turnover suggests

Q56: At any meeting of the Federal Open

Q110: People can write checks against<br>A) demand deposits

Q209: Which of the following is not a

Q225: Suppose that monetary neutrality and the Fisher

Q227: If the reserve ratio is 5 percent,then

Q367: You put money into an account and

Q379: Banks can hold deposits at the Federal

Q423: Most job search in the U.S.economy takes

Q536: Discouraged workers are people who want to