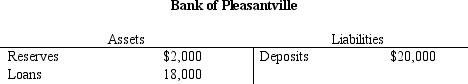

Table 21-5.

-Refer to Table 21-5.Assume the Fed's reserve requirement is 9 percent and all banks besides the Bank of Pleasantville are exactly in compliance with the 9 percent requirement.Further assume that people hold only deposits and no currency.Starting from the situation as depicted by the T-account,if the Bank of Pleasantville decides to make new loans so as to end up with no excess reserves,then by how much does the money supply eventually increase?

Definitions:

Cumulative Probability Distribution

A function that gives the probability that a random variable is less than or equal to a certain value.

Monte Carlo Analysis

A statistical technique that uses random sampling and simulation to estimate the probability of different outcomes in a process or decision-making.

Random Number Range

The interval within which random numbers can be generated, used in simulations and probabilistic models to represent unpredictable variables.

Monte Carlo Analysis

A computational algorithm that uses random sampling to obtain numerical results, typically used to solve problems that might be deterministic in principle.

Q12: Refer to Table 21-5.Assume there is a

Q23: The money supply increases when the Fed<br>A)

Q181: According to the classical dichotomy,when the money

Q208: When inflation rises,firms make<br>A) more frequent price

Q216: Minimum-wage laws affect all workers.

Q285: When the money market is drawn with

Q298: Darla puts her money into a bank

Q305: According to the classical dichotomy,which of the

Q418: An American worker who becomes unemployed typically

Q496: Most economists agree that eliminating unemployment insurance