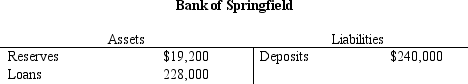

Table 21-6.

-Refer to Table 21-6.If the Bank of Springfield has lent out all the money it can given its level of deposits,then what is the reserve requirement?

Definitions:

Internal Rate of Return

The discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

Cost of Capital

The rate of return a company must pay investors to finance its assets, often used as a benchmark to evaluate the profitability of investments.

Present Values

The today's equivalent value of future money or cash flow series, calculated with a defined rate of return.

Cash Inflows

Money received by a business from its activities, e.g., sales of goods, provision of services, loans received.

Q1: Small time deposits are included in<br>A) M1

Q20: A bank has $200,000 in deposits and

Q64: The Bureau of Labor Statistics' U-1 measure

Q112: In the U.S.,taxes on capital gains are

Q160: According to the classical dichotomy,which of the

Q208: Because people move into and out of

Q238: The normal rate of unemployment around which

Q269: When you purchase school supplies at the

Q398: If the Federal Reserve increases the interest

Q531: The Bureau of Labor Statistics' U-1 measure