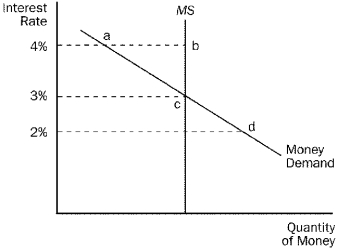

Figure 24-1

-Refer to Figure 24-1.Which of the following is correct?

Definitions:

Fisher Effect

An economic theory suggesting that the real interest rate is independent of monetary measures, with the nominal interest rate adjusting to expected inflation.

Rate Of Return

is the gain or loss on an investment over a specific period, expressed as a percentage of the investment’s initial cost.

Inflation Risk

The likelihood that the value of assets or income will decrease as inflation shrinks the purchasing power of a currency.

Term Structure

The relationship between interest rates or bond yields and different terms to maturity, typically depicted in a yield curve.

Q23: Changes in the interest rate help explain<br>A)

Q25: The financial intermediaries that the average person

Q53: Refer to Pessimism.Which curve shifts and in

Q61: Which of the following events would shift

Q79: Other things the same,if workers and firms

Q227: Refer to Figure 24-2.What is measured along

Q262: According to the theory of liquidity preference,the

Q264: If the dollar appreciates,perhaps because of speculation

Q393: Technological progress shifts the long-run aggregate supply

Q441: In the long run,technological progress<br>A) and increases