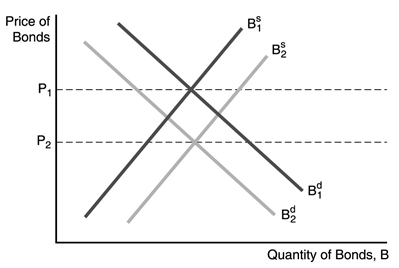

Use the following figure to answer the questions :

-In the figure above,the price of bonds would fall from P1 to P2

Definitions:

Call Contract

A financial contract that gives the buyer the right, but not the obligation, to buy an asset or security at a predetermined price within a specific time period.

Premium

The additional amount above the nominal or face value that an investor pays to buy a security or the cost to purchase an insurance policy.

MBI Stock

Refers to the stock of a specific company identified by the ticker symbol MBI, typically requiring further context or identification of the company.

Put Contract

A put contract is a financial agreement giving the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time frame.

Q18: According to the segmented markets theory of

Q24: During a "flight to quality"<br>A)the spread between

Q39: Since it does not have to be

Q44: Which of the following is included in

Q73: According to the efficient markets hypothesis,the current

Q81: The predominant form of household debt is<br>A)consumer

Q95: People hold money even during inflationary episodes

Q97: Secondary markets make financial instruments more<br>A)solid.<br>B)vapid.<br>C)liquid.<br>D)risky.

Q101: Typically,borrowers have superior information relative to lenders

Q126: An important feature of money market mutual