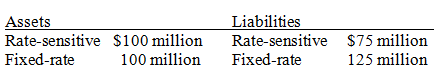

Your bank has the following balance sheet

What would happen to bank profits if the interest rates in the economy go down? Is there anything that you could do to keep your bank from being so vulnerable to interest rate movements?

Definitions:

Short-run Economic Profits

Profits earned by a firm in the short run, where not all inputs can be varied and some fixed costs are still incurred.

Competitive Industries

Sectors of the economy where businesses actively compete with each other to offer goods or services to consumers, often characterized by low barriers to entry and a high level of innovation.

Allocative Efficiency

A state of resource allocation where goods and services are distributed according to consumer preferences, maximizing overall societal welfare.

Productive Efficiency

A situation where a firm or economy produces output at the lowest possible cost, using all its resources efficiently.

Q7: The goals of bank asset management include<br>A)maximizing

Q25: The theory of rational expectations,when applied to

Q30: Using the liquidity preference framework,what will happen

Q40: Reasons regulators chose to follow regulatory forbearance

Q71: When a corporation announces a major decline

Q75: Currency circulated by banks that could be

Q88: Suppose your payroll check is directly deposited

Q106: The riskiness of an asset is measured

Q134: If a bank has excess reserves of

Q195: If reserves in the banking system increase