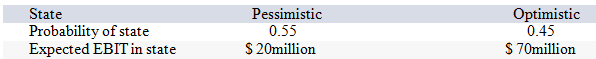

Your company doesn't face any taxes and has $750 million in assets, currently financed entirely with equity. Equity is worth $25 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

Definitions:

Output Per Head

The average production of goods and services per individual in a specific period, typically used to measure labor productivity.

Accelerated

A process or rate that increases speed or velocity, often used in various contexts such as economic growth or depreciation.

Industrial Revolution

The period of major industrialization that took place during the late 1700s and early 1800s, significantly changing the economy, society, and culture of the time through advancements in technology.

Technological Change

The process of innovation and development in technology, leading to new products, improved processes, and increased efficiency.

Q11: The choice of foreign location,at times,generates unique

Q18: A firm faces a 30 percent tax

Q20: Which of the following can be a

Q23: International capital budgeting will require that managers:<br>A)recognize

Q56: Which of the following is NOT a

Q90: Which of the following is NOT included

Q111: China's exchange rate is a:<br>A)freely floating regime.<br>B)managed

Q120: Which statement is true regarding cost-cutting proposals?<br>A)The

Q124: If a firm has a cash cycle

Q135: Which of the following will decrease the