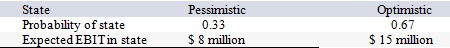

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

Definitions:

Smooth Muscle

A type of muscle found in the walls of hollow organs like the intestines and blood vessels, characterized by its involuntary control and lack of striations.

Pelvic Splanchnic Nerves

Nerves that arise from the sacral spinal nerves, contributing to the autonomic innervation of the pelvic organs.

Parasympathetic Division

Part of the autonomic nervous system responsible for conserving energy and restoring the body to a state of calm after periods of stress or danger.

Preganglionic Neurons

Neurons of the autonomic nervous system that extend from the central nervous system to the autonomic ganglia.

Q9: A capital budgeting method that converts a

Q13: Sipe's Paint and Wallpaper, Inc., needs to

Q14: One way to account for flotation costs

Q17: You are considering the purchase of one

Q34: Calculate the total fees a firm would

Q40: Jan's Bakery is considering a merger with

Q43: If a firm has a cash cycle

Q55: Suppose your firm is considering two

Q66: Your firm needs a machine which costs

Q80: We accept projects with a positive NPV