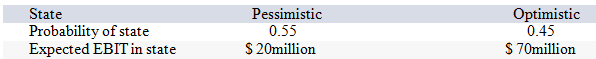

Your company doesn't face any taxes and has $750 million in assets, currently financed entirely with equity. Equity is worth $25 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

Definitions:

Year 0 Value

Year 0 Value is a reference point in financial analysis indicating the value of an investment or project at the beginning period before any growth or decline.

Weighted Average

Weighted average is a calculation that takes into account the varying degrees of importance of the numbers in a data set.

Free Cash Flows

The amount of cash generated by a business that is available for distribution to its securities holders after capital expenditures.

Year 0 Value

A reference to the initial value or investment amount at the beginning of a project or investment period, often used in financial analysis.

Q12: Projects A and B are mutually exclusive.

Q17: Which of the following involves a firm

Q35: Which of the following is the most

Q35: The World Social Forum:<br>A)was organized as an

Q40: Which of the following can be computed

Q52: If a firm has a cash cycle

Q71: Your company has a 40 percent tax

Q75: During the last year you have had

Q77: Sky, Inc. normally pays a quarterly dividend.

Q97: Basketball Games, Inc., with the help of