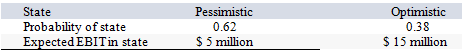

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Descriptive/Correlational Research

A research methodology that observes and describes behavior without influencing it, and may involve measuring the relationship between two or more variables.

Experimental Research

A systematic and scientific approach to research in which the researcher manipulates one variable to observe the effect on another variable.

Psychologist

A professional specializing in the study of the mind and behavior, often involved in research, counseling, or clinical practice.

Case Study Method

A research technique that involves the intensive examination of an individual or group to reveal underlying principles or findings.

Q1: George's Dry Cleaning is considering a merger

Q25: An asset's cost plus the amounts you

Q34: All of the following are ways to

Q50: All of the following are the different

Q56: A pro-rata distribution of additional shares of

Q64: The current spot rate between the U.S.

Q76: Suppose a firm pays total dividends of

Q92: If the law of one price does

Q102: Of the capital budgeting techniques discussed, which

Q104: A large amount of foreign direct investment