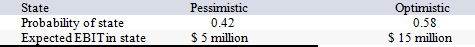

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Visual

Relating to sight or the ability to see, encompassing all aspects of perceiving the world through the eyes.

Auditory

Pertaining to hearing, including the organs involved in hearing and the perception of sound.

Mental Retardation

An outdated term previously used to describe a condition characterized by significant limitations in both intellectual functioning and in adaptive behavior, which covers many everyday social and practical skills. The term now replaced by Intellectual Disability.

Visual Illusions

Perceptual experiences that differ from reality, where what we see does not match the physical measurement of the stimulus source.

Q8: Cups N Saucers, Inc. normally pays a

Q24: Which of the following argues that dividends

Q34: Crib World is considering a merger with

Q37: Mick E Inc. plans to issue 25

Q37: Suppose that LilyMac Photography has annual sales

Q39: Suppose a firm has a retention ratio

Q39: Your firm needs a machine which costs

Q70: A project's IRR is the interest rate

Q83: Which of these is a political and

Q104: Your firm needs a machine which costs