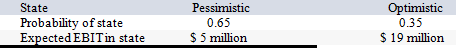

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 15 percent yield on perpetual debt. What will be the break-even level of EBIT?

Definitions:

International Financial Reporting Standards

Global accounting principles that provide guidance for companies on how to report financial events and conditions.

Prohibited

Refers to actions or activities that are forbidden by law, regulation, or policy.

LIFO

"Last In, First Out," an inventory valuation method where the most recently produced or acquired items are the first to be expensed.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating how efficiently a company produces or buys its products.

Q4: You are trying to pick the least-expensive

Q8: Suppose that Wind Em Corp. currently has

Q10: To trace cash flows through the firm's

Q16: Section 179 allows a business, with certain

Q43: Which of the following is defined as

Q58: Painting, Inc. has sales of $400,000 and

Q62: GBH Inc. is planning on announcing a

Q79: If the price of silver in England

Q84: Suppose that Lil John Industries' equity is

Q134: If a firm's inventory ratio increases, what