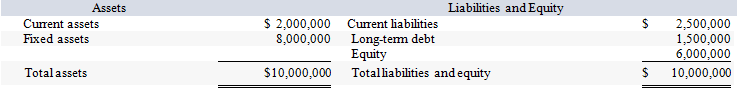

Suppose that Wind Em Corp. currently has the balance sheet shown as follows, and that sales for the year just ended were $15 million. The firm also has a profit margin of 23 percent, a retention ratio of 40 percent, and expects sales of $20 million next year. If all assets and current liabilities are expected to grow with sales, what is the projected increase in retained earnings?

Definitions:

Timely

Occurring within an expected time frame or period, often used to refer to the punctual execution or delivery of tasks.

Fundamental Analysis Approach

An investment evaluation method that examines a company's financial statements, health, and market position to determine its value.

Future Cash Flows

Estimates of the amount of money expected to flow in and out of the business in the future, including revenues, expenses, and investments.

Relevant Financial Information

Financial data or insights that can inform decision-making processes, typically relating to a company's performance, market trends, or economic conditions.

Q3: Which of these is the type of

Q7: Suppose a firm has had the historical

Q13: Rings N Things Industries has 40 million

Q18: Suppose your firm is considering investing

Q44: You have approached your local bank for

Q65: Compute the payback statistic for Project

Q65: Regarding dividend payment procedures, which of the

Q69: Which of the following is NOT one

Q76: Suppose your firm is considering two

Q106: Suppose that Papa Bell Inc.'s equity is