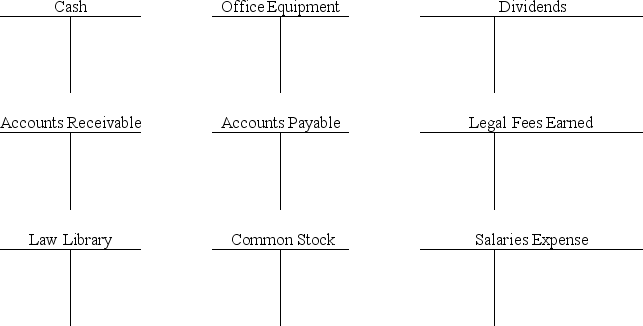

Mary Sunny began business as Sunny Law Firm, Inc. on November 1. Record the following November transactions by making entries directly to the T-accounts provided. Then, prepare a trial balance, as of November 30.

a) Mary invested $15,000 cash and a law library valued at $6,000.

b) Purchased $7,500 of office equipment from John Bronx on credit.

c) Completed legal work for a client and received $1,500 cash in full payment.

d) Paid John Bronx. $3,500 cash in partial settlement of the amount owed.

e) Completed $4,000 of legal work for a client on credit.

f) The company paid $2,000 cash in dividends to the owner. (sole shareholder)

g) Received $2,500 cash as partial payment for the legal work completed for the client in (e).

h) Paid $2,500 cash for the legal secretary's salary.

Definitions:

Grouping

The cognitive process of organizing objects or thoughts into groups based on common attributes, which is fundamental to perception and pattern recognition.

Perceptual Organization

The process by which the brain structures and interprets sensory information to represent the environment.

Openness

A personality trait that features characteristics such as imagination and insight, and those high in this trait also tend to have a broad range of interests.

Closure

The emotional or psychological resolution or conclusion that comes after a significant event or experience, often helping individuals move on.

Q8: A total debt ratio of 0.35:<br>A) indicates

Q46: Which of the following statements about depreciation

Q61: Johnson's Nursery has net income of $42,500,depreciation

Q75: At his death,Jose owned real estate worth

Q76: Adjusted taxable gifts are included when calculating

Q81: The chronological record of each complete transaction

Q86: Which of the following is least likely

Q98: Which of the following items should not

Q148: Revenues are:<br>A) The same as net income.<br>B)

Q154: Posting is the transfer of journal entry