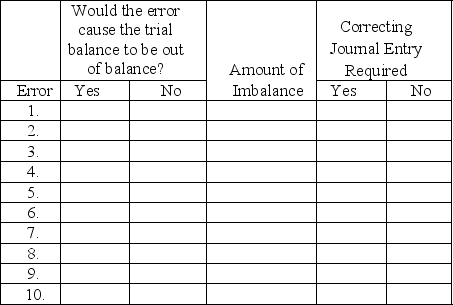

At year-end, Henry Laundry Service, Inc. noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5. A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by Del Henry was recorded as a debit to Common Stock and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash withdrawal by the stockholder was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Definitions:

Batch Level Activity

Activities and costs associated with processing a batch of units, which occur each time a batch is handled or processed, regardless of the number of units in the batch.

Activity-Based Product Costing

A costing method that allocates overhead and indirect costs to products based on the activities required to produce them.

Product Line

A group of related products marketed by a company, often sharing a common theme, technology, or target market.

Activity-Based Costing System

A costing methodology that assigns costs to products or services based on the activities required to produce them, considering the resources consumed by each activity.

Q12: This year Maria transferred $600,000 to an

Q29: Cash paid to stockholders by the business

Q51: A financial institution:<br>A) is a kind of

Q51: Which one of the following is an

Q53: The foreign tax credit regime is the

Q66: A record in which the effects of

Q97: This year,Brent by himself purchased season baseball

Q171: Jet Styling, Inc. has the following

Q176: Rico's Taqueria had cash inflows from operating

Q212: Cage Company had income of $350 million