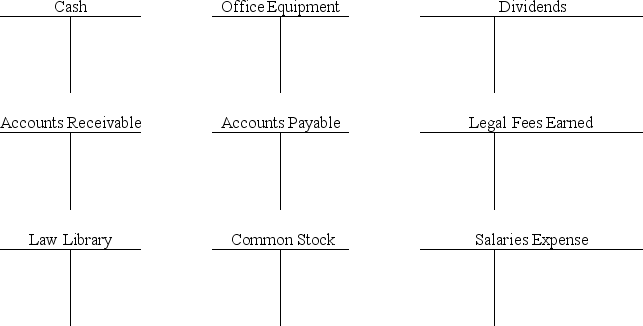

Mary Sunny began business as Sunny Law Firm, Inc. on November 1. Record the following November transactions by making entries directly to the T-accounts provided. Then, prepare a trial balance, as of November 30.

a) Mary invested $15,000 cash and a law library valued at $6,000.

b) Purchased $7,500 of office equipment from John Bronx on credit.

c) Completed legal work for a client and received $1,500 cash in full payment.

d) Paid John Bronx. $3,500 cash in partial settlement of the amount owed.

e) Completed $4,000 of legal work for a client on credit.

f) The company paid $2,000 cash in dividends to the owner. (sole shareholder)

g) Received $2,500 cash as partial payment for the legal work completed for the client in (e).

h) Paid $2,500 cash for the legal secretary's salary.

Definitions:

Net Income

The profit a company retains after all expenses and taxes have been removed from its revenue.

Inventory

A company's merchandise, raw materials, and finished and unfinished products which have not yet been sold.

Perpetual Inventory Method

An inventory management system where updates are made continuously to record sales and purchases instantly, maintaining constant and accurate inventory records.

Consolidation Worksheet

A tool used in accounting to combine the financial statements of parent and subsidiary companies into a single document for analysis.

Q24: No deductions are allowed when calculating the

Q44: Insurance companies provide a mechanism for individuals

Q47: If Houston Company billed a client for

Q66: Which of the following expenses incurred by

Q81: Based on generally accepted accounting principles,assets are

Q83: The primary objective of managerial accounting is

Q85: Creditors' claims on assets that reflect company

Q110: On January 1 of the current year,

Q167: _ are promises of payment from customers

Q191: List the four steps in recording transactions.