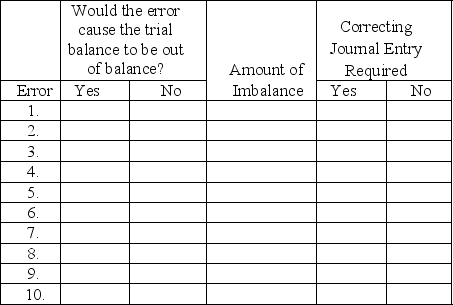

At year-end, Henry Laundry Service, Inc. noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5. A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by Del Henry was recorded as a debit to Common Stock and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash withdrawal by the stockholder was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Definitions:

Self-discrepancy Theory

A theory that delineates how differences between one's actual self, ideal self, and ought self can influence emotions and self-esteem.

Undesired Self

Refers to the aspects of oneself that a person does not wish to identify with or sees as contrary to their ideal or desired self-image.

Ought Self

Represents an individual's understanding of what others expect them to be, often focused on duties, obligations, and societal expectations.

Preexisting Attitudes

Attitudes or opinions that an individual holds before being exposed to new information or experiences.

Q15: Ricardo transferred $1,000,000 of cash to State

Q23: Balsco's balance sheet shows total assets of

Q27: Corporate raiders will be looked upon most

Q34: Andrea transferred $500,000 of stock to a

Q43: A financial intermediary invests in financial assets

Q88: A firm with spare cash<br>A) should always

Q141: A more structured format that is similar

Q148: Jerry's Butcher Shop, Inc. had the

Q182: A double-entry accounting system is an accounting

Q222: The financial statement that summarizes the changes