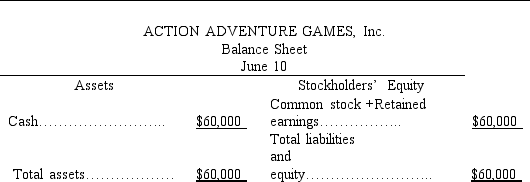

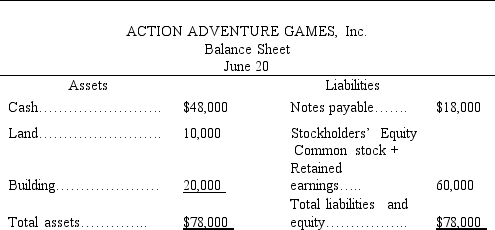

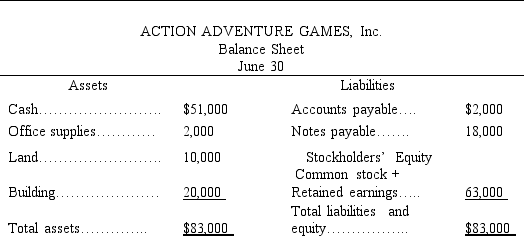

The accountant of Action Adventure Games, Inc. prepared a balance sheet after every 10 day period. The only resources invested by the owner were at the start of the company on June 1. During June, the first month of operation, the following balance sheets were prepared:

Required:

Required:

Describe the nature of each of the four transactions that took place between the balance sheet dates shown. Assume only one transaction affected each account.

10

20

30

Definitions:

Straight-Line

A technique for computing depreciation or amortization that involves uniformly distributing an asset's cost across its lifespan.

Assets

Resources owned by a person or entity that are expected to provide future economic benefits.

Depreciation Expense

An accounting method that allocates the cost of tangible asset over its useful life, reflecting how the asset loses value over time.

Accumulated Depreciation

The total depreciation of an asset up to a specific point in time, reflecting wear and tear or obsolescence.

Q11: The sales and use tax base varies

Q15: Natsumi is a citizen and resident of

Q33: Which one of these statements is correct?<br>A)

Q42: All passive income earned by a CFC

Q54: Deductible interest expense incurred by a U.S.corporation

Q65: Proceeds of life insurance paid due to

Q68: Based on the following trial balance

Q74: Describe the link between a business's income

Q127: S corporations generally recognize gain or loss

Q242: The accounting equation can be restated as:<br>