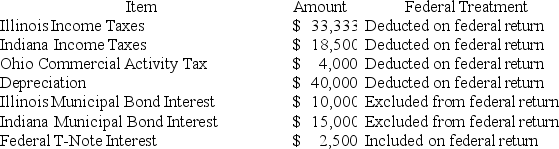

Hoosier Incorporated is an Indiana corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:  State depreciation expense was $50,000.Hoosier's Federal Taxable Income was $150,300.Calculate Hoosier's Illinois state tax base.

State depreciation expense was $50,000.Hoosier's Federal Taxable Income was $150,300.Calculate Hoosier's Illinois state tax base.

Definitions:

1970s

A decade characterized by significant social, political, and technological changes, marked by events such as the Vietnam War, the Watergate scandal, and the advent of personal computing.

Family Therapy

A form of psychotherapy that aims to reduce distress and conflict by improving the systems of interactions between family members.

Eating Disorders

Mental disorders that involve serious disturbances in eating behavior, such as anorexia nervosa and bulimia nervosa.

Adolescents

Individuals in the transitional stage of physical and psychological development that generally occurs during the period from puberty to legal adulthood (age of maturity).

Q33: Knoxville Corporation,a U.S.corporation,incurred $300,000 of research and

Q53: Which of the following sales is always

Q77: The assets of a company total $700,000;

Q81: Tyson,a one-quarter partner in the TF Partnership,receives

Q100: Which of the following class of stock

Q104: A balance sheet covers activities over a

Q108: Which of the following is not a

Q113: S corporation shareholders are not allowed to

Q172: There are three major types of business

Q241: Assets created by selling goods and services