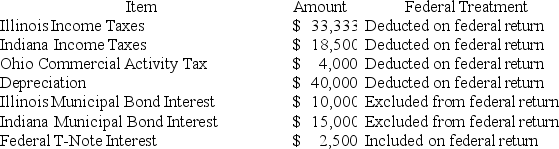

Hoosier Incorporated is an Indiana corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:  State depreciation expense was $50,000.Hoosier's Federal Taxable Income was $150,300.Calculate Hoosier's Illinois state tax base.

State depreciation expense was $50,000.Hoosier's Federal Taxable Income was $150,300.Calculate Hoosier's Illinois state tax base.

Definitions:

Gardner's Syndrome

Gardner's Syndrome is a genetic disorder characterized by the growth of multiple noncancerous tumors in the colon, along with tumors outside the colon and various other symptoms.

Familial Carcinogenesis

The process by which cancer is caused or influenced by genetic factors passed down in families, increasing the risk of developing certain types of cancer.

Mobility Problems

Challenges or limitations faced by an individual in moving around effectively, often due to physical disabilities or health conditions.

Memory Loss

describes the unusual forgetfulness where one may have difficulty remembering events, information, or experiences.

Q2: ER General Partnership,a medical supplies business,states in

Q25: Assume Joe Harry sells his 25% interest

Q34: On March 15,20X9,Troy,Peter,and Sarah formed Picture Perfect

Q36: Wyoming imposes an income tax on corporations.

Q65: Proceeds of life insurance paid due to

Q71: Red Blossom Corporation transferred its 40 percent

Q81: Big Company and Little Company are both

Q85: Sybil transfers property with a tax basis

Q95: Publicly traded corporations cannot be treated as

Q108: Jason is one of 100 shareholders in