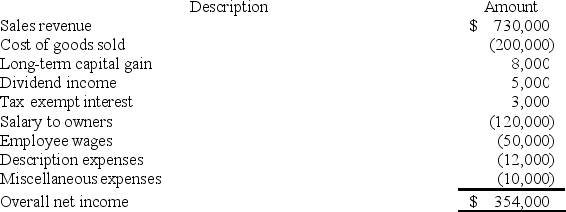

XYZ Corporation (an S corporation)is owned by Jane and Rebecca who are each 50% shareholders.At the beginning of the year,Jane's basis in her XYZ stock was $40,000.XYZ reported the following tax information for 2017.

Required:

Required:

a.What amount of ordinary business income is allocated to Jane?

b.What is the amount and character of separately stated items allocated to Jane?

c.What is Jane's basis in her XYZ corp.stock at the end of the year?

Definitions:

Contractual Right

A legal entitlement derived from a contract that allows one party to demand a particular action or outcome from another party.

Reliable Measurement

The degree to which information is consistently accurate and dependable, providing a true representation of a financial situation.

Original Investigation

A detailed study or research conducted for the first time to gain new knowledge or insights.

New Knowledge

Information or insights gained that were previously unknown, contributing to the understanding or development of a subject area or field.

Q4: Simone transferred 100 percent of her stock

Q15: Ricardo transferred $1,000,000 of cash to State

Q33: Tim,a real estate investor,Ken,a dealer in securities,and

Q44: Manchester Corporation,a U.S.corporation,incurred $100,000 of interest expense

Q47: Which of the following statements best describes

Q58: Janet Mothra,a U.S.citizen,is employed by Caterpillar Corporation,a

Q70: Gary and Laura decided to liquidate their

Q90: Entities no longer have to classify deferred

Q92: Which of the following factors would not

Q111: Public Law 86-272 protects certain business activities