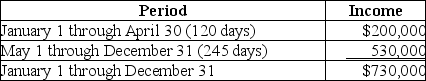

ABC was formed as a calendar-year S corporation with Alan,Brenda and Conner as equal shareholders.On May 1,2017,ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation Conner,Inc.ABC reported business income for 2017 as follows (assume that there are 365 days in the year):

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1 - April 30)and the C corporation short tax year (May 1 − December 31),how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2017?

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1 - April 30)and the C corporation short tax year (May 1 − December 31),how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2017?

Definitions:

Securities Exchange Commission

A U.S. government agency responsible for regulating the securities industry, enforcing federal securities laws, and ensuring investor protection.

National Labor Relations Act

The National Labor Relations Act (or Wagner Act) created the NLRB, which administers most labor law in the United States.

Norris-La Guardia Act

A 1932 U.S. federal law that prohibited employers from requiring employees to sign agreements not to join a labor union and also limited the issuing of court injunctions in labor disputes.

Executive Order 11246

A U.S. presidential order that prohibits federal contractors from discriminating against employees on the basis of race, color, religion, sex, or national origin.

Q8: Vintner,S.A.,a French corporation,received the following sources of

Q28: Giselle is a citizen and resident of

Q48: Which of the following statements is true?<br>A)

Q68: Yellowstone Corporation made a distribution of $300,000

Q72: Ted is a 30% partner in the

Q88: Discuss the steps necessary to determine whether

Q93: Partners adjust their outside basis by adding

Q94: Which of the following statements is correct?<br>A)

Q103: An S corporation shareholder's allocable share of

Q114: Clampett,Inc.has been an S corporation since its