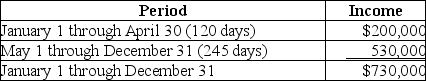

ABC was formed as a calendar-year S corporation with Alan,Brenda and Conner as equal shareholders.On May 1,2017,ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation Conner,Inc.ABC reported business income for 2017 as follows (assume that there are 365 days in the year):

If ABC uses the specific identification method to allocate income,how much will it allocate to the S corporation short year and C corporation short year?

If ABC uses the specific identification method to allocate income,how much will it allocate to the S corporation short year and C corporation short year?

Definitions:

Rapid Subduction

A geologic process involving the quick descent of one tectonic plate beneath another plate into the mantle, often leading to significant geological events like earthquakes and volcanism.

Shield Volcanoes

These are characterized by their extensive size and gentle slopes, produced by the effusion of low-viscosity lava that can travel far from the source.

Basalt Lava

Molten rock that emerges from the earth during a volcanic eruption, characterized by its high iron and magnesium content, and low viscosity.

Flood Basalts

Extensive flows of basaltic lava that cover large areas of land or the ocean floor, resulting from massive eruptions.

Q16: The Canadian government imposes a withholding tax

Q24: Under the entity concept,a partnership interest is

Q25: The gross estate will not include the

Q33: For the holidays,Samuel gave a necklace worth

Q62: The trade-show rule allows businesses to maintain

Q93: The executor of Isabella's estate incurred administration

Q94: Last year Brandon opened a savings account

Q99: Which of the following isn't a typical

Q112: At her death,Serena owned real estate worth

Q121: The following schedule reflects shows the first